Western-educated, young Mongolian Deputy Minister of Finance Kh.Bulgantuya briefed public on difficult fiscal situation. Amended 2016 budget was approved with consolidated fiscal deficit of 18%, reduction from expected execution of 20.6% by original 2016 budget. Budget had large shortfalls due to aggressive fiscal projections including ones on major projects such as Gatsuurt (not delivered). Some of Government’s (GoM) proposed cuts and all tax hikes have been rejected by Parliament, however, Ministry of Finance continues to plan tax system reform.

Western-educated, young Mongolian Deputy Minister of Finance Kh.Bulgantuya briefed public on difficult fiscal situation. Amended 2016 budget was approved with consolidated fiscal deficit of 18%, reduction from expected execution of 20.6% by original 2016 budget. Budget had large shortfalls due to aggressive fiscal projections including ones on major projects such as Gatsuurt (not delivered). Some of Government’s (GoM) proposed cuts and all tax hikes have been rejected by Parliament, however, Ministry of Finance continues to plan tax system reform.

Government of Mongolia wants to recover FDI by moving forward 5 major projects, specifically:

- OT Underground project,

- TT project,

- TT power plant,

- TT railroad and

- Gatsuurt.

IMF Standby Program: The Deputy Minister acknowledged that quickly and successfully implementing IMF Standby Program as in 2009 would not be easy.

World Bank said, “Recent announcement of the accurate fiscal situation was a significant step toward a credible fiscal consolidation. The revised revenue projections of the government seem largely realistic, based on conservative assumptions. Projected high budget deficit and rapidly rising government debt, however, urgently call for a comprehensive and strong fiscal consolidation plan, including spending adjustment based on priorities and revenue mobilization measures.” The Bank also stated that there is a strong need for prioritizing expenditures to protect the vulnerable and improving public expenditure efficiency.

SUMMARY OF THE DEPUTY MINISTER’S INTERVIEW

Mongolian Deputy Minister of Finance Kh.Bulgantuya (MA Economics from Yale University, ex-OT, ex-Petrovis, former MPP Secretary) has said in an interview on Friday, September 16

"Amended 2016 budget has been approved. Fiscal revenues have been revised downward by ~MNT1.7t (~US$850m) to MNT5.3t (~US$2.65b). Fiscal expenditures were adjusted upwards by MNT1.7t (~US$850m) to MNT9.7t (~US$4.85b), resulting in consolidated budget deficit of MNT4.3t (~US$2.15b) or 18% of GDP. We had to proactively amend budget to reflect ongoing decline of the revenues and increase in the expenditures since shortfall of fiscal revenues was likely to reach MNT4-5t (US$2-2.5b) and deficit was expected to reach 20.6% of GDP by execution of original approved 2016 budget. Secondly, we consolidated Mongolia’s four, five budgets. Due to consolidation, fiscal deficit increased ~4x from MNT1.2t deficit in 2015. Offbudget spending of MNT1.4t (US$700m) particularly had impact in this respect. We reduced deficit to 18%. Economy, as a whole, is in decline, for example, only import revenues declined 30% y-o-y. Also, Economic Transparency law did not result in significant tax revenues.

Very optimistic projections, including ones on several major projects such as Gachuurt, were reason for decline in fiscal revenues. Also, navigation revenues projections were too aggressive at 30% increase. Further, privatization of several large SOE-s was not executed as planned.

Some fiscal cuts proposed by Government were declined by Parliament. The legislature did not support paycuts for senior state officials. Severance subsidy for state officials was not reduced from 36 months pay. We attempted to cut all noncritical expenses, such as fuel, postal, conference and events expenses by 50%. Children’s cash transfers of MNT 21,000 per month have run out of funding and were stopped since July. We reflected it in the amendment; children monies will be issued till end of 2016. Children of targeted group or ~60% of total children will receive cash, remaining 40% will be opened accounts on their names and they will be able to cash out since 2019. We have stopped indefinitely mutual retirement benefits because Social Insurance Fund (SIF) does not have necessary ~MNT50b funding. Student’s monthly subsidy of MNT70K per month will be issued till end of 2016, however on condition of fulfilling all previous requirements. Only SIF is burdening budget by requiring subsidy from budget of MNT400-500b (~US$200-250m) per year. Four years later, the SIF fiscal burden is expected to reach MNT1t (~US$500m) per year.

Government proposal for tax hikes on very minor part of population and certain sectors were not approved by Parliament. But we are researching several options. Tax hikes proposed by Government will not impact ordinary citizen. Tax hike will only impact 1-2% of taxpayers. Majority of Mongolian people do not own gold deposits, do not live in apartments more than 150 sq. meters, do not have salary more than MNT2.5m and do not own liquor and tobacco businesses. Going forward, it would be proper to implement income level based tax. Countries with same GDP per capita have income taxes with 5 levels from 5% to 35%. Further, Mongolian economy has grown in size.

We have no right to continue another 4 years funded by external debt at any cost and pretend that everything is fine. Mongolian economy is in really difficult shape and Ministers, who are also MP-s, are working under great pressure. In 2017 and 2018 budget has not sufficient funds to pay all debt principal and interest payments even if we don’t pay salaries to anyone and don’t fund current expenses of any kindergarten. In another words, we have more debt than our income.

We will restore trust of foreign investors by moving forward OT Underground project, TT project, TT power plant, TT railroad and Gatsuurt project. Negotiations on major projects will be done this fall. Investors don’t trust Mongolian authorities because previously even projects approved by Parliament were returned.

It will be hard to quickly and successfully implement the IMF program like in 2009. Last time Mongolia was in IMF Standby Program in 2009, Mongolian economy was relatively small. We had no debt of more than US$20b as we do now. Consumption of Mongolia has hugely expanded; it is not easy to reduce it. In particular, in last 4 years because of unlimited luxury consumption, Mongolian state has eaten and borrowed our future, said “it is ok, our children will pay it”. We must now to use all our internal resources and capabilities in union of state, private sector and citizens, all together for the country’s good. Some foreign country or some good soul somewhere will not fund Mongolian state".

WORLD BANK FISCAL COMMENTARY

According to National Statistics Office of Mongolia, fiscal deficit reached MNT 1.8 trillion in Jan-Aug, ~2.34x increase from MNT769b in the same period last year.

In Mongolia Economic Brief released on September 6 (before approval of amended 2016 budget), World Bank has said that

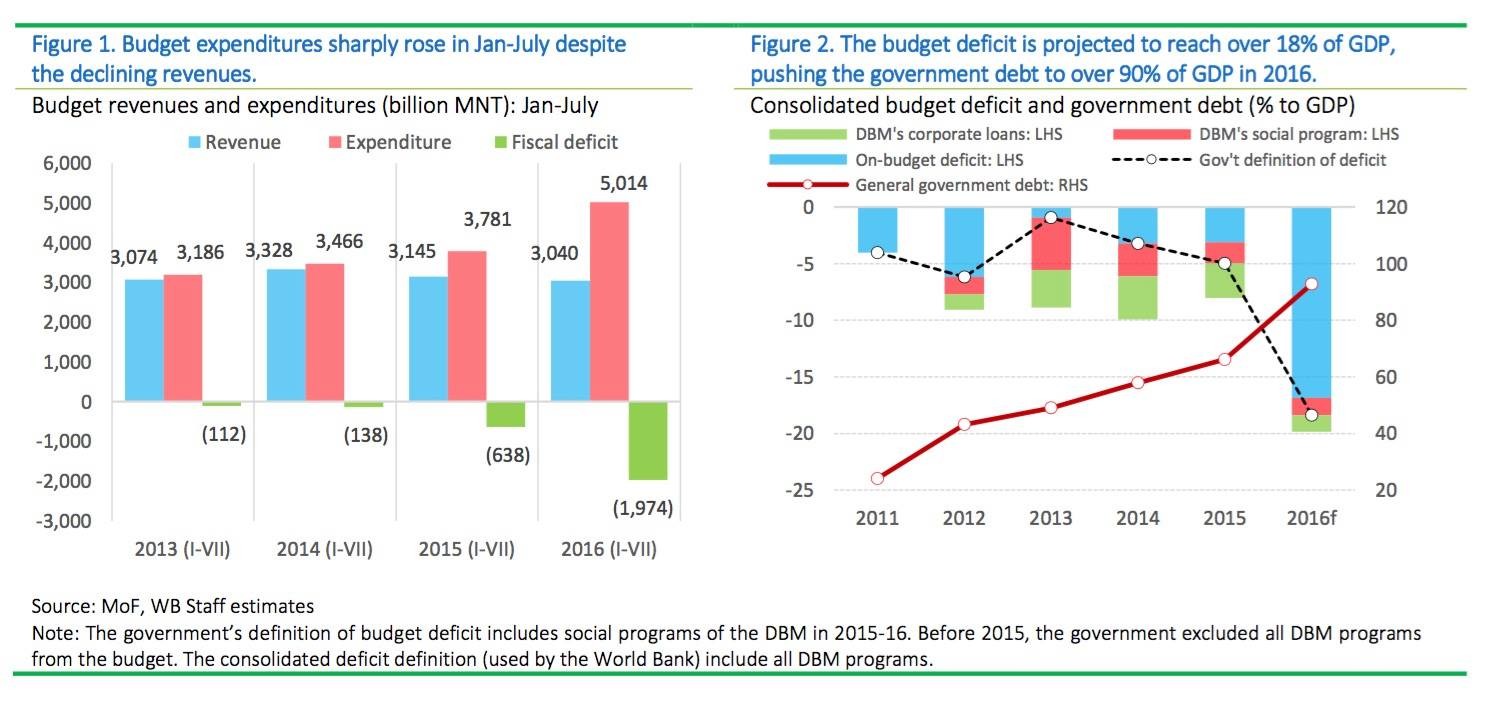

“Weaker commodity prices and import contraction were reflected in budget revenues felling by 3.3 percent (yoy) in the same period. Mining revenues sharply dropped, with royalties almost halving from one year ago. Customs duties declined by over 10 percent due to weaker imports. Non-tax revenues also declined by 4.3 percent, reflecting a 33 percent drop in oil revenues, and minimal collection of dividends and privatization revenues. “

“Unbudgeted spending programs and loose spending controls largely contributed to budget expenditures jumping by 33 percent (yoy) in Jan-July. Government programs were launched in the first half. These programs included three policy loan programs (Good Herder/Student/Fence Programs) and a buyback program of the ETT shares owned by Mongolian citizens (Good Share Program). In Mar-July, over MNT 500 billion was spent for the four Good Programs. These programs were not recorded in the budget execution report until July, and have been funded by the BoM. Many of the on-budget expenditures also exceeded the original budget plan, including the Child Money Program, interest payments, and public investment spending. In addition, the government spent over MNT 400 billion in Mar-July for the Housing Mortgage Program that was previously undertaken by the BoM. The mortgage program spending, however, is yet to be recorded in the budget execution report. “

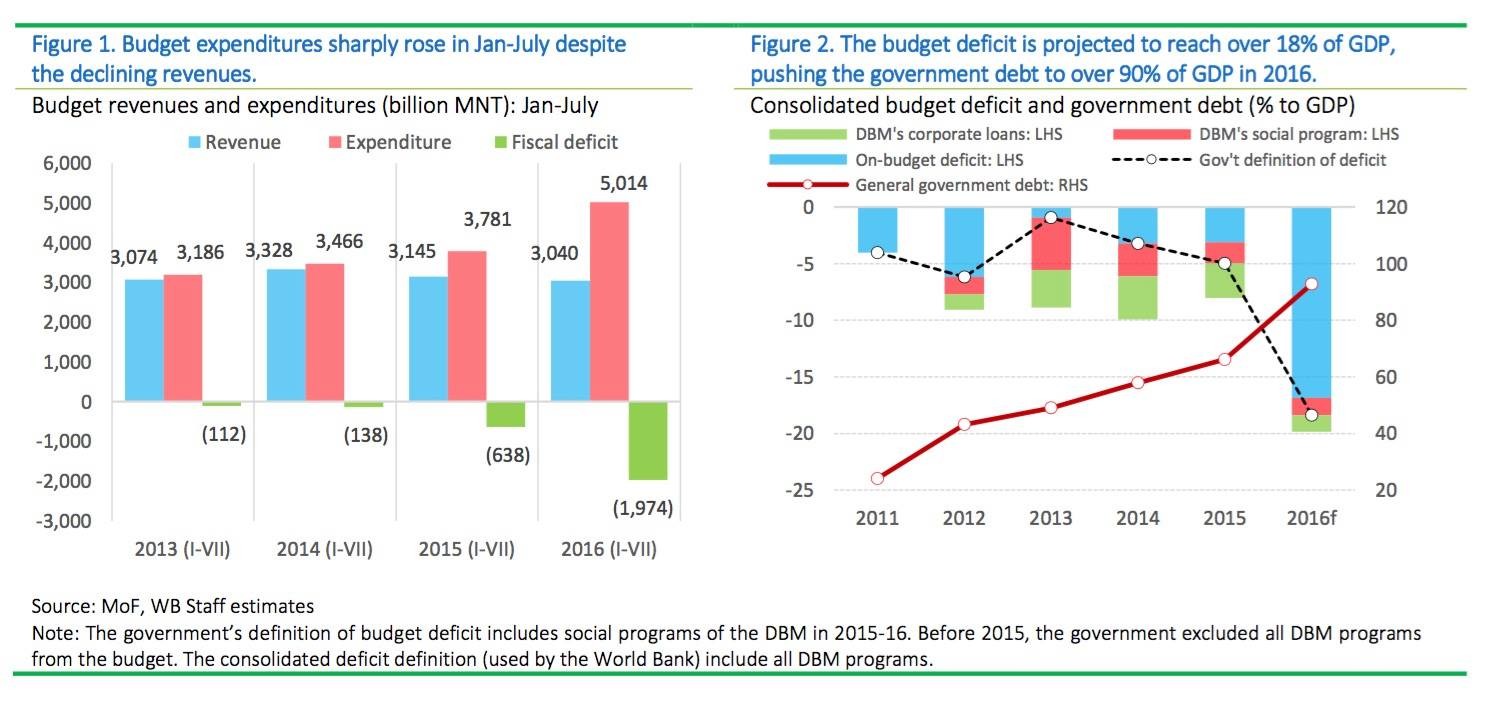

“Corrective measures have been taken by the government. The proposed budget, however, excluded the Housing Mortgage Program that was transferred to the government in March. The commercial portfolio of the DBM still remains off the budget. A revised Medium Term Fiscal Framework for 2016-18 was also submitted to the parliament. The consolidated overall budget deficit—which adds DBM’s off-budget commercial portfolio to the government’s definition—is expected to reach over 19 percent of GDP by end- 2016.

The recent measures taken by the new government are welcome, but further actions are urgently needed. The immediate challenge facing the new government was to contain the sharp rise in budget deficit and consolidate unbudgeted expenditures. The recent announcement of the accurate fiscal situation was a significant step toward a credible fiscal consolidation. The revised revenue projections of the government seem largely realistic, based on conservative assumptions. Projected high budget deficit and rapidly rising government debt, however, urgently call for a comprehensive and strong fiscal consolidation plan, including spending adjustment based on priorities and revenue mobilization measures. The fiscal consolidation plan should also include all of the remaining off-budget programs such as Housing Mortgage Program and DBM’s off- budget corporate lending programs that would likely increase fiscal burden.”

Nominal value of general government debt, including the sovereign-guaranteed TDB debt and the outstanding debt of the Build-Transfer (BT) projects, is projected to reach over 90 percent of GDP due to the high deficit and exchange rate depreciation, a sharp rise from 66 percent of GDP in 2015.

There is a strong need for prioritizing expenditures to protect the vulnerable and improving public expenditure efficiency. Weakening growth and declining household consumption, despite the large increase in government spending this year, suggests that public expenditures may not be productive enough to support growth and jobs, underscoring the need for proper assessment of public expenditure efficiency and effectiveness. Particularly, the most recent poverty analysis showed that poverty closely tracks growth and consumption. The recent high unemployment rate and a sharp drop in household consumption indicate that many households near the poverty line may be sliding back to poverty, putting a drag on growth. Strengthening the social safety net, particularly targeting the vulnerable groups near or below the poverty line, would help mitigate the social costs of fiscal adjustment and support growth.

Source: Mongolia Metals & Mining

Western-educated, young Mongolian Deputy Minister of Finance Kh.Bulgantuya briefed public on difficult fiscal situation. Amended 2016 budget was approved with consolidated fiscal deficit of 18%, reduction from expected execution of 20.6% by original 2016 budget. Budget had large shortfalls due to aggressive fiscal projections including ones on major projects such as Gatsuurt (not delivered). Some of Government’s (GoM) proposed cuts and all tax hikes have been rejected by Parliament, however, Ministry of Finance continues to plan tax system reform.

Western-educated, young Mongolian Deputy Minister of Finance Kh.Bulgantuya briefed public on difficult fiscal situation. Amended 2016 budget was approved with consolidated fiscal deficit of 18%, reduction from expected execution of 20.6% by original 2016 budget. Budget had large shortfalls due to aggressive fiscal projections including ones on major projects such as Gatsuurt (not delivered). Some of Government’s (GoM) proposed cuts and all tax hikes have been rejected by Parliament, however, Ministry of Finance continues to plan tax system reform.

Government of Mongolia wants to recover FDI by moving forward 5 major projects, specifically:

- OT Underground project,

- TT project,

- TT power plant,

- TT railroad and

- Gatsuurt.

IMF Standby Program: The Deputy Minister acknowledged that quickly and successfully implementing IMF Standby Program as in 2009 would not be easy.

World Bank said, “Recent announcement of the accurate fiscal situation was a significant step toward a credible fiscal consolidation. The revised revenue projections of the government seem largely realistic, based on conservative assumptions. Projected high budget deficit and rapidly rising government debt, however, urgently call for a comprehensive and strong fiscal consolidation plan, including spending adjustment based on priorities and revenue mobilization measures.” The Bank also stated that there is a strong need for prioritizing expenditures to protect the vulnerable and improving public expenditure efficiency.

SUMMARY OF THE DEPUTY MINISTER’S INTERVIEW

Mongolian Deputy Minister of Finance Kh.Bulgantuya (MA Economics from Yale University, ex-OT, ex-Petrovis, former MPP Secretary) has said in an interview on Friday, September 16

"Amended 2016 budget has been approved. Fiscal revenues have been revised downward by ~MNT1.7t (~US$850m) to MNT5.3t (~US$2.65b). Fiscal expenditures were adjusted upwards by MNT1.7t (~US$850m) to MNT9.7t (~US$4.85b), resulting in consolidated budget deficit of MNT4.3t (~US$2.15b) or 18% of GDP. We had to proactively amend budget to reflect ongoing decline of the revenues and increase in the expenditures since shortfall of fiscal revenues was likely to reach MNT4-5t (US$2-2.5b) and deficit was expected to reach 20.6% of GDP by execution of original approved 2016 budget. Secondly, we consolidated Mongolia’s four, five budgets. Due to consolidation, fiscal deficit increased ~4x from MNT1.2t deficit in 2015. Offbudget spending of MNT1.4t (US$700m) particularly had impact in this respect. We reduced deficit to 18%. Economy, as a whole, is in decline, for example, only import revenues declined 30% y-o-y. Also, Economic Transparency law did not result in significant tax revenues.

Very optimistic projections, including ones on several major projects such as Gachuurt, were reason for decline in fiscal revenues. Also, navigation revenues projections were too aggressive at 30% increase. Further, privatization of several large SOE-s was not executed as planned.

Some fiscal cuts proposed by Government were declined by Parliament. The legislature did not support paycuts for senior state officials. Severance subsidy for state officials was not reduced from 36 months pay. We attempted to cut all noncritical expenses, such as fuel, postal, conference and events expenses by 50%. Children’s cash transfers of MNT 21,000 per month have run out of funding and were stopped since July. We reflected it in the amendment; children monies will be issued till end of 2016. Children of targeted group or ~60% of total children will receive cash, remaining 40% will be opened accounts on their names and they will be able to cash out since 2019. We have stopped indefinitely mutual retirement benefits because Social Insurance Fund (SIF) does not have necessary ~MNT50b funding. Student’s monthly subsidy of MNT70K per month will be issued till end of 2016, however on condition of fulfilling all previous requirements. Only SIF is burdening budget by requiring subsidy from budget of MNT400-500b (~US$200-250m) per year. Four years later, the SIF fiscal burden is expected to reach MNT1t (~US$500m) per year.

Government proposal for tax hikes on very minor part of population and certain sectors were not approved by Parliament. But we are researching several options. Tax hikes proposed by Government will not impact ordinary citizen. Tax hike will only impact 1-2% of taxpayers. Majority of Mongolian people do not own gold deposits, do not live in apartments more than 150 sq. meters, do not have salary more than MNT2.5m and do not own liquor and tobacco businesses. Going forward, it would be proper to implement income level based tax. Countries with same GDP per capita have income taxes with 5 levels from 5% to 35%. Further, Mongolian economy has grown in size.

We have no right to continue another 4 years funded by external debt at any cost and pretend that everything is fine. Mongolian economy is in really difficult shape and Ministers, who are also MP-s, are working under great pressure. In 2017 and 2018 budget has not sufficient funds to pay all debt principal and interest payments even if we don’t pay salaries to anyone and don’t fund current expenses of any kindergarten. In another words, we have more debt than our income.

We will restore trust of foreign investors by moving forward OT Underground project, TT project, TT power plant, TT railroad and Gatsuurt project. Negotiations on major projects will be done this fall. Investors don’t trust Mongolian authorities because previously even projects approved by Parliament were returned.

It will be hard to quickly and successfully implement the IMF program like in 2009. Last time Mongolia was in IMF Standby Program in 2009, Mongolian economy was relatively small. We had no debt of more than US$20b as we do now. Consumption of Mongolia has hugely expanded; it is not easy to reduce it. In particular, in last 4 years because of unlimited luxury consumption, Mongolian state has eaten and borrowed our future, said “it is ok, our children will pay it”. We must now to use all our internal resources and capabilities in union of state, private sector and citizens, all together for the country’s good. Some foreign country or some good soul somewhere will not fund Mongolian state".

WORLD BANK FISCAL COMMENTARY

According to National Statistics Office of Mongolia, fiscal deficit reached MNT 1.8 trillion in Jan-Aug, ~2.34x increase from MNT769b in the same period last year.

In Mongolia Economic Brief released on September 6 (before approval of amended 2016 budget), World Bank has said that

“Weaker commodity prices and import contraction were reflected in budget revenues felling by 3.3 percent (yoy) in the same period. Mining revenues sharply dropped, with royalties almost halving from one year ago. Customs duties declined by over 10 percent due to weaker imports. Non-tax revenues also declined by 4.3 percent, reflecting a 33 percent drop in oil revenues, and minimal collection of dividends and privatization revenues. “

“Unbudgeted spending programs and loose spending controls largely contributed to budget expenditures jumping by 33 percent (yoy) in Jan-July. Government programs were launched in the first half. These programs included three policy loan programs (Good Herder/Student/Fence Programs) and a buyback program of the ETT shares owned by Mongolian citizens (Good Share Program). In Mar-July, over MNT 500 billion was spent for the four Good Programs. These programs were not recorded in the budget execution report until July, and have been funded by the BoM. Many of the on-budget expenditures also exceeded the original budget plan, including the Child Money Program, interest payments, and public investment spending. In addition, the government spent over MNT 400 billion in Mar-July for the Housing Mortgage Program that was previously undertaken by the BoM. The mortgage program spending, however, is yet to be recorded in the budget execution report. “

“Corrective measures have been taken by the government. The proposed budget, however, excluded the Housing Mortgage Program that was transferred to the government in March. The commercial portfolio of the DBM still remains off the budget. A revised Medium Term Fiscal Framework for 2016-18 was also submitted to the parliament. The consolidated overall budget deficit—which adds DBM’s off-budget commercial portfolio to the government’s definition—is expected to reach over 19 percent of GDP by end- 2016.

The recent measures taken by the new government are welcome, but further actions are urgently needed. The immediate challenge facing the new government was to contain the sharp rise in budget deficit and consolidate unbudgeted expenditures. The recent announcement of the accurate fiscal situation was a significant step toward a credible fiscal consolidation. The revised revenue projections of the government seem largely realistic, based on conservative assumptions. Projected high budget deficit and rapidly rising government debt, however, urgently call for a comprehensive and strong fiscal consolidation plan, including spending adjustment based on priorities and revenue mobilization measures. The fiscal consolidation plan should also include all of the remaining off-budget programs such as Housing Mortgage Program and DBM’s off- budget corporate lending programs that would likely increase fiscal burden.”

Nominal value of general government debt, including the sovereign-guaranteed TDB debt and the outstanding debt of the Build-Transfer (BT) projects, is projected to reach over 90 percent of GDP due to the high deficit and exchange rate depreciation, a sharp rise from 66 percent of GDP in 2015.

There is a strong need for prioritizing expenditures to protect the vulnerable and improving public expenditure efficiency. Weakening growth and declining household consumption, despite the large increase in government spending this year, suggests that public expenditures may not be productive enough to support growth and jobs, underscoring the need for proper assessment of public expenditure efficiency and effectiveness. Particularly, the most recent poverty analysis showed that poverty closely tracks growth and consumption. The recent high unemployment rate and a sharp drop in household consumption indicate that many households near the poverty line may be sliding back to poverty, putting a drag on growth. Strengthening the social safety net, particularly targeting the vulnerable groups near or below the poverty line, would help mitigate the social costs of fiscal adjustment and support growth.

Source: Mongolia Metals & Mining